Here and Now

Justin Sydnor on Rising Costs for ACA Health Insurance Plans

Clip: Season 2400 Episode 2420 | 5m 27sVideo has Closed Captions

Justin Sydnor on why the costs of Health Insurance Marketplace plans continue rising.

Wisconsin School of Business risk management and insurance professor Justin Sydnor explains why the costs of Health Insurance Marketplace plans continue rising and the impacts of uncompensated care.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Here and Now is a local public television program presented by PBS Wisconsin

Here and Now

Justin Sydnor on Rising Costs for ACA Health Insurance Plans

Clip: Season 2400 Episode 2420 | 5m 27sVideo has Closed Captions

Wisconsin School of Business risk management and insurance professor Justin Sydnor explains why the costs of Health Insurance Marketplace plans continue rising and the impacts of uncompensated care.

Problems playing video? | Closed Captioning Feedback

How to Watch Here and Now

Here and Now is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipto be a really hot topic going forward.

Sommerhauser, thanks very much.

>> The whole government shutdown was over extending enhanced tax credits for Affordable Care Act policies, with Democrats warning of big increases in people's monthly premiums come January if they're not kept in place.

Aside from those extra subsidies going away, why are marketplace plans proving more expensive?

And what of Republican calls to do away with the ACA altogether?

In response, we asked Wisconsin School of and Insurance Justin Sydnor.

And thanks very much for being here.

>> Thanks for having me.

>> So is it in dispute that ACA premiums could more than double without the extension of the enhanced tax credits?

>> No.

uncertainty about that.

You know, it's basically pretty straightforward, simple math.

The way the tax credits work is that they're tied to a share of the percent of your income.

And the enhanced tax credits increased or decreased the share you would have to pay an increase the income range for people who are eligible.

So they'll definitely go up.

The share that you're up.

If those subsidies expire.

How much?

Depends a lot on your income level.

And in particular, we could maybe think about a nice example here.

So take a 50 year old couple so married couple in Wisconsin, 50 years old, no children.

They're facing a total premium of about $18,000 for a middle middle plan this year in the ACA marketplace in Wisconsin.

If they had the enhanced tax credits and they made $85,000 or more a year, that's 400% of the federal poverty line.

They'd get about $11,000 subsidy, and they'd have to pay about $7,000 themselves.

So if those subsidies expire, they're on the hook for that whole 18,000.

So that's an $11,000 increase now for people who have lower incomes, the subsidies protect them more, even if the enhanced subsidies expire.

So let's take that same family and move them way down the income spectrum.

Make them at 25,000.

Now they're just above the poverty line in the enhanced subsidies.

They don't pay anything for that middle tier plan.

They're paying zero.

But without them they're paying about $500 a year.

So about a $500 increase.

So that range, you know, in the ballpark some it's 500 a year, some people it's $10,000 or more a year.

>> You know, there's so much political consternation around not just the tax credits but the ACA altogether is the Affordable Care Act in a freefall?

>> No, I don't think there's any reason to think of it as being in a freefall.

It's actually been quite stable.

So if you look at the cost of plans for ACA marketplace plans, both in Wisconsin but also nationally over the last five years or so, those premiums have actually been very stable.

And in fact, they haven't risen in the same way that the employer sponsored premiums that we've seen for, you know, that most people get through their employers have those premiums have been up about 25% over the last five years.

ACA premiums are pretty stable.

>> What's driving that 25% increase?

overall in the US our healthcare costs are just high.

So we pay about $15,000 a person per year in health care costs across the entire country.

You know.

And those costs reflect a lot of things.

They reflect our market based system.

So our costs are about twice what they are in, say, Europe or Canada.

And, you know, that's partly a trade off.

We have a market based system.

So we have a lot of innovation.

We have good access, we have the best technology.

So if you get very sick, you probably want to be here.

On the other hand, it means that our prices are set by competitive forces and the down prices that well through those competitive about why are they increasing, why are they steady rise over time.

You know there's a confluence of factors.

So we have an aging population.

So we have sort of more demand for health care and the expansion of health care services.

How many nurses you can bring on, how many doctors you train.

Hospital systems doesn't always keep up with that rising demand.

Well, we've also seen a big explosion of newer pharmaceutical drugs.

You know, innovations in genetics have allowed us to treat rare diseases.

Those Now, of course, they're also highly beneficial.

If you have a rare disease, you're really happy that there's a new drug for it.

But that's been a big part of the cost.

And then there's also just overall inflation.

So there's been inflation in all parts of the economy.

And that also hits the health care prices.

>> So I wanted to ask you I know that President Trump and members of the GOP talk about giving people direct payments like $2,000 or something to to pay for their health care and a health savings account or something like that.

What do you think of that?

>> Well.

>> So, you know, it's hard to react too much.

So, you know, the details and specifics really matter in health care.

And so far the proposals haven't been very detailed.

But if you instead gave people direct money that could be spent on anything health care premiums or out-of-pocket costs, you expose them to some more risk.

If those subsidies don't keep up with the rising costs of health care, well, they're going to see that.

On the other hand, you create more competitive pressure and competitive pressure and

Charles Franklin on Trump's Approval Ratings as 2025 Ends

Video has Closed Captions

Clip: S2400 Ep2420 | 5m 13s | Charles Franklin on approval ratings for President Donald Trump as the midterms begin. (5m 13s)

Here & Now opening for November 21, 2025

Video has Closed Captions

Clip: S2400 Ep2420 | 1m 5s | The introduction to the November 21, 2025 episode of Here & Now. (1m 5s)

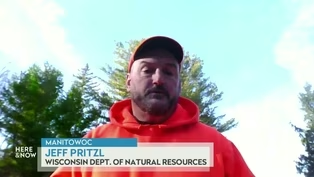

Jeff Pritzl on Wisconsin's 2025 Gun Deer Hunt Season Outlook

Video has Closed Captions

Clip: S2400 Ep2420 | 8m 43s | Jeff Pritzl on prospects for Wisconsin's 2025 gun deer hunt and population management. (8m 43s)

Mark Sommerhauser on Online Sports Betting Law in Wisconsin

Video has Closed Captions

Clip: S2400 Ep2420 | 7m 3s | Mark Sommerhauser on the legal status of online sports betting in the state. (7m 3s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

Here and Now is a local public television program presented by PBS Wisconsin